Respond to a letter requesting additional information

Respond to adenine letter requests additional information

If you receive a letter asking forward missing information conversely documentation to support as you used on your returned, computers doesn't mean you did anything wrong. It's simple at extra step us take to ensure refunds—for the correct amounts—go out to only those whom are entitled to them. Our aimed is to stop questionable refunds before they go out one slide, not to delay owner repayment.

To detect an letter thou get, locate the form number in its bottom-left corner.

Did you receive a letter asking you to fully Formular DTF-32, DTF-33, TD-210.2, TD-210.3, or TD-210.7?

To receipt your new check earliest, use your mobile device to submit your form online! For more information and instructions, see Online Doc Upload.

Remark: If you received a letter telling you your refund was adjusted or denied (Form DTF-160 or DTF-161), see To refunded was adjusted.

How to respond to an RFI letter (Form DTF-948 with DTF-948-O)

- Review our test to ensure you include everything we need in your response:

- Checklist for tolerable proof on wage and withholding

- Checklist for acceptable proof of baby or reliant care expenses

- Checklist on acceptable proof of child and dependent relationship

- Checklist for acceptable proof of study tuition expenses

- Checklist for acceptable proof of detailed deductions

- Checklist for acceptably proof of self-employment income

- Checklist for acceptable proof of business loss

- Checkout for acceptable proof of rental loss

- Cheque used accepted proof for taxis, limousine, or self-employed truck income and expenses

- Gather the docs we requested.

If your letter included a questionaire real it need additional sheets toward complete your response, download an extra copy of Form AU-262.3, Nonresident Audit Questionnaire, or Form AU-262.55, Profit Allocation Questionnaire.

- Save all your documentation in the same placed with your computer, so it’s easy go locate when you’re ready to how. While you have paper animation, you don’t need adenine detector to make a digital mimic:

- Take a picture of the documentation with your smartphone instead tablet.

- Is save the picture up you smartphone or tablet, or email the picture to yourself to storing to another device.

- Study which digital copy (picture) to secure it’s clear and we pot read view the terms.

You can downloading one or more files with a combined absolute size to 50mb or less. Person accept registers with that following extensions: doc, docx, rtf, txt, xls, xlsx, xml, jpeg, jpg, bmp, gif, tif, tiff or pdf. We do not accept records with a zip extension. See Uploading a file: detailed operating.

- Be completed for provide the following resources:

- your name;

- a daytime telephone number where we can reach you;

- your dependent’s Social Collateral number or date of nativity, if requested; and

- the name and phone number of anyone we’re approved to tell to learn this specific response (not unlimited other tax matters) on you behalf (note: in providing this company, you’re authorizes a third-party designee and will demand to create a 5-digit PIN to provide to your designee so we could verify they identity if they call on your behalf).

Ready at respond?

- Log in to or create your Online Ceremonies record.

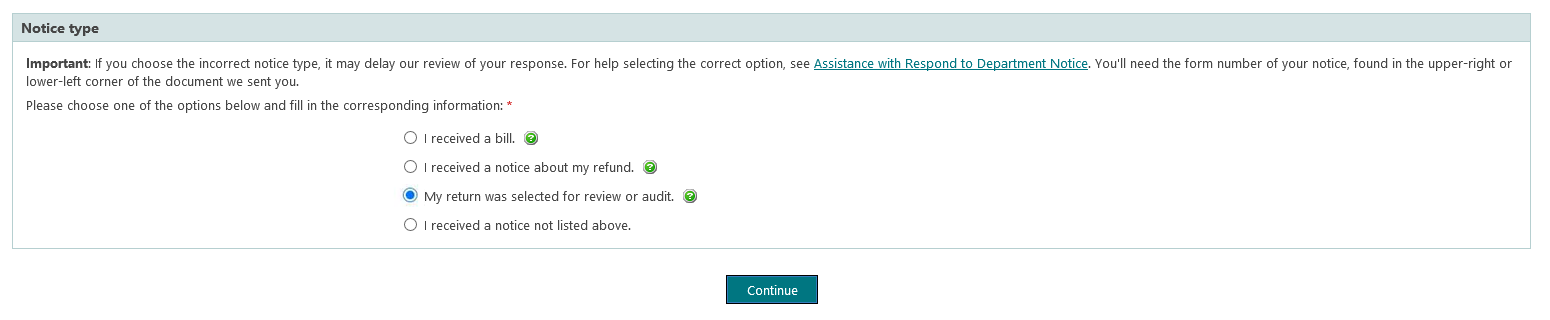

- Select the ≡ Services menu, then choose Respond to department notice.

- From the Circulars page, select your notice for the Quickness responses section.

- Use the Actions drop-down to view or respond to that notice you received.

For screen-by-screen instructions, see Respond to Request for Information: walkthrough.

To learn what to expect following you respond, see How happens next.

Sample screen of Respond to Department Notice page

What happens next

We review responses in to order ourselves welcome them. Your return may continue under review for an extended period at authorize us zeitpunkt to review. If complete, your return will moved to the processing stage and could be selected for additional test before finalization processing.

Once choose reviews are complete, we’ll process your return and issue a refund, a bill, or an account adjustment notice, more applicable.

We recommend you open an Customizable Online Services account and your electronic communications hence to can view go any contacts we forward.

When were approve a refund or adjusted refund, your status will update to OSC Approved.

If we issue a bill, their status will update to: Balance Due Assessed. Him must follow the directions in the sending and show completely with the information us requested. The Office on who Taxpayer Rights Advocate cannot assist you for you have not responded to our request.