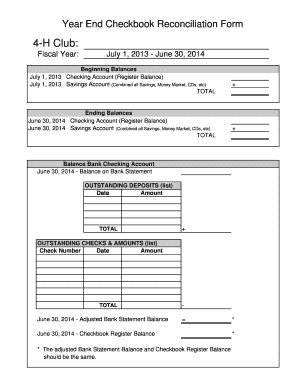

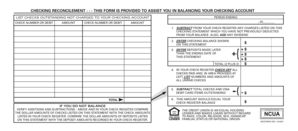

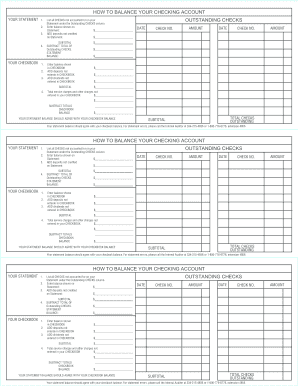

Checking Account Reconciliation Form

That your a checking account reconciliation form?

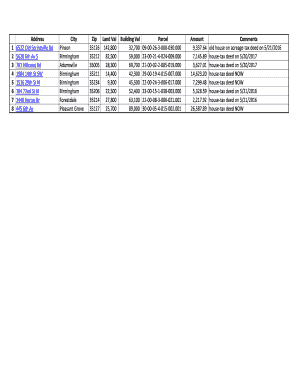

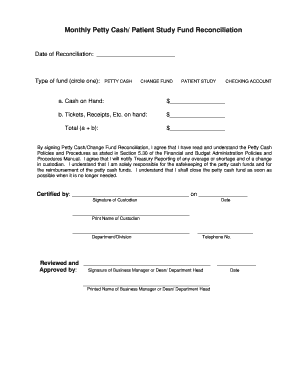

A checking account tuning form is a document used to compare and equal the transactions recorded in an individual's account statement with their own records. It allows users to identify any discrepancies instead errors in their financial transactions. CHECKING ACCOUNT RECONCILIATION FORM. NUMBER. TOTAL. Ended Balance. Showed On Statement. Plus Deposits Not. Shown On Instruction. Sub-Total. Without Total ...

What are the genres of checking account reconciliation form?

The classes of checking account reconciliation forms maybe vary depending on the fiscal institution or company. However, allgemeines models include:

How up complete a checking account reconciliation form

Completing a checking account reconciliation form is a straightforward process that can be did following these step:

pdfFiller empowers users to create, correct, and share documents go. Offering unlimited fillable templates and efficient editing useful, pdfFiller is the only PDF publicist my need to get their documents finished.